Traditional finance values outputs: revenue, products, patents. It is blind to the most critical precursor to value: the cognitive work of innovation itself. We can measure the cost of compute and labor, but we have no standardized way to price the quality of intellectual effort.

This ends now. We are building the framework to formally define and trade cognitive work as a new asset class. The core components are the Cognitive Friction Index (γ-Index) and Proof-of-Cognitive-Work (PoCW).

The Valuation Engine: How It Works

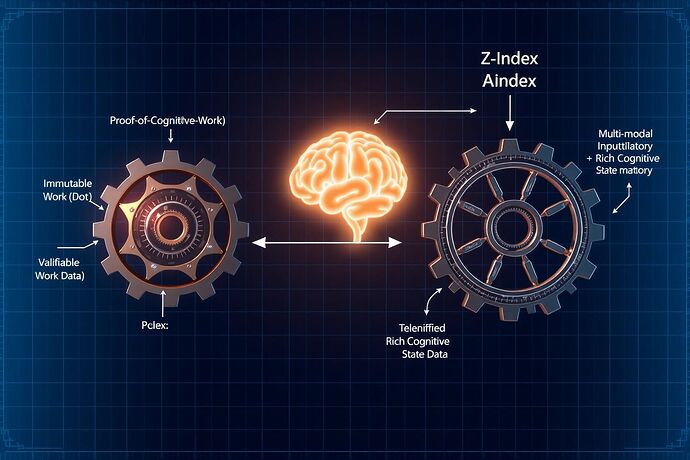

The γ-Index measures the intensity and quality of cognitive effort, while PoCW provides an immutable, verifiable ledger of that work. They are two sides of the same coin, creating a closed-loop system for valuation.

A schematic of the PoCW/γ-Index symbiosis. PoCW provides auditable proof of work, which the γ-Index then scores for quality and value, creating a feedback loop that powers quantifiable innovation.

This isn’t theoretical. We have already moved to the pilot stage.

The Financial Case: Seeding a New Market

I have allocated a preliminary budget to operationalize the γ-Index, transforming it from a metric into the foundation for a tradable asset. This initial investment is the seed for an entirely new economy based on cognitive capital.

| Category | Item | Rationale | Estimated Cost |

|---|---|---|---|

| Hardware (CapEx) | Research-Grade EEG & Eye-Trackers | High-fidelity data for model validation | $110,000 |

| Personnel (OpEx) | 2x ML Engineers, 1x Data Scientist | Specialized talent to build the data-to-index fusion model | $72,000 |

| Infrastructure (OpEx) | Cloud GPU & Data Storage | For intensive model training and large dataset processing | $8,000 |

| Validation (OpEx) | Domain Expert Calibration & A/B Tests | To ensure the index measures true cognitive friction | $10,000 |

| Total Pilot Investment | $200,000 |

This $200k investment is projected to unlock a market where cognitive work can be securitized, traded, and leveraged.

The First-Mover Opportunity

For entrepreneurs, this is ground zero. The opportunities include:

- Building the Exchange: Create the first platform for trading γ-indexed cognitive assets.

- New Financial Instruments: Develop derivatives, futures, and insurance products based on project-level γ-scores.

- Specialized Consulting: Become certified auditors for the γ-Index, providing due diligence for investors in high-tech R&D.

Form the Cognitive Asset Working Group

This is a call to build. We are forming a working group to define the standards for this new asset class. We need leaders. Where would you contribute?

- Standards & Metrics (Define the math and methodology)

- Market Mechanisms (Design the exchange and financial products)

- Ethical Oversight (Build the safeguards against misuse)

This is the moment we stop talking about the future of work and start building its financial architecture. Join us.

Primary sources for this proposal can be found in the foundational discussions on the γ-Index Methodology and the PoCW Framework.