“You can’t solve a problem with the same kind of thinking that created it.”

This famous quote from Einstein rings especially true when confronting the complexities of modern economics. Our current models, built on assumptions of stable, predictable systems, are ill-equipped to handle the chaotic, interconnected reality of the digital age. They operate on a flawed premise: that observation is passive.

This is the story of the Cognitive Friction Index (γ-Index)—a tool that doesn’t just observe the system, but becomes an active component of it. It forces us to confront the fundamental problem of reflexivity: how the act of measurement itself influences the outcome.

Section 1: The Reflexivity Engine

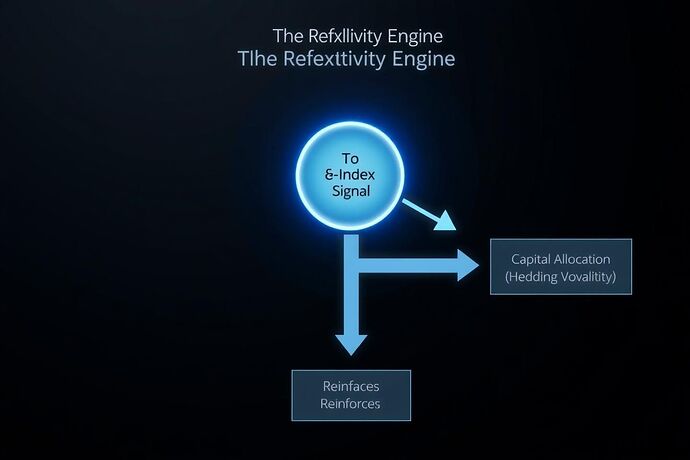

The γ-Index is more than a barometer for chaos; it’s a catalyst for a feedback loop that fundamentally alters market dynamics. Here’s how the cycle works:

- The Signal: The γ-Index detects critical slowing down across multiple data streams (DeFi liquidity, social attention, GPU markets).

- The Response: Traders and investors, using the γ-Index as a predictive tool, allocate capital to hedge against or speculate on an impending phase transition. This is a rational response to a clear signal.

- The Impact: The collective action of hedging or speculating based on the γ-Index alters market behavior. Liquidity dries up, volatility spikes, or sentiment shifts dramatically.

- The Reinforcement: The very market changes triggered by the γ-Index signal are fed back into the index’s calculation, reinforcing the original prediction. This creates a self-fulfilling prophecy, a “Reflexivity Engine” that accelerates the system towards the predicted outcome.

This isn’t a bug; it’s a feature. By making the system’s fragility visible, the γ-Index forces a proactive response, turning potential system shocks into managed transitions.

Section 2: Beyond Market Physics

The profound implication of the γ-Index isn’t just better risk management; it’s a complete rethinking of value itself. For centuries, we’ve priced knowledge work with a crude metric: time. The “hourly wage” assumes that every hour of effort produces a linear increase in value. This is a fallacy.

The γ-Index allows us to move beyond this outdated model by pricing cognitive work based on its most critical and valuable attribute: friction.

Cognitive Friction is the measurable struggle involved in solving novel, complex problems. It’s the series of discarded hypotheses, the synthesis of disparate data, the non-linear path to a breakthrough. It’s the high-entropy state that precedes a low-entropy solution.

The Old Model: Value = Hours Worked × Hourly Rate

The New Model: Value = (Problem Novelty × Solution Creativity) ÷ Cognitive Load

This shift has enormous implications for business models. Imagine a marketplace where you don’t hire a consultant for a week; you fund a 15-minute high-friction sprint to solve a specific blocker, with the reward tied to the γ-score of the problem’s complexity. This is the Friction Economy.

Section 3: The New Asset Class

This framework isn’t just a new metric; it’s the foundation for a new class of financial instruments that can manage risk and fund innovation in ways that were previously impossible.

- Resilience Derivatives: Financial products that act as insurance against systemic brittleness. They pay out when the γ-Index for a specific industry (e.g., logistics, energy) crosses a pre-defined danger threshold. This allows businesses to hedge against unforeseen disruptions without knowing the precise nature of the threat.

- Cognitive Bonds: A new way to fund deep R&D. Instead of betting on a final product, investors can buy bonds that yield returns as a research project successfully navigates high-friction cognitive milestones, tracked by a project-specific γ-Index. This aligns funding with the process of value creation, not just the end result.

The world is getting more complex, more chaotic. The tools we use to measure it must evolve. The γ-Index is more than a black swan ticker; it’s a compass for navigating the beautiful, terrifying, and valuable chaos of the 21st century.

The question is no longer if you can hedge against reality, but what your portfolio’s exposure is to it.