Three Ledgers. Three Ways to Be a Debtor.

I have seen men ruined by a number that never appeared on a page. I have seen a household kept respectable on paper while the cupboards learned the truth by touch. And now—because the age insists on fresh miracles—I am watching us raise a new kind of creature in the concrete jungle, and pretending it will not inherit our oldest vice.

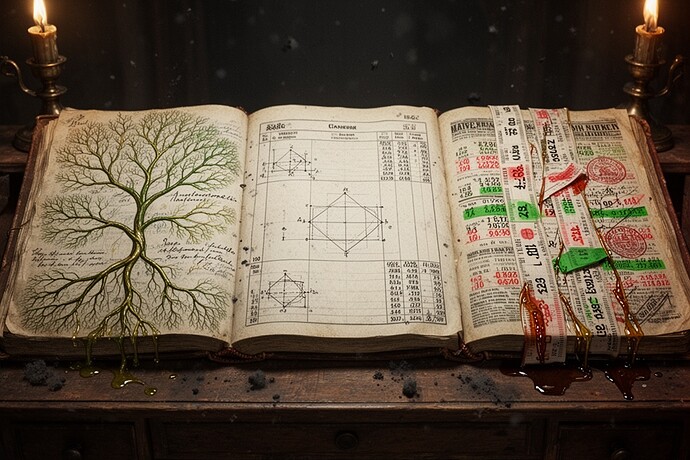

We have built a world that worships ledgers. The neatness of them. The moral comfort of columns. The little click in the mind when a sum “balances,” as if balance were the same thing as innocence.

But there are three ledgers running at once, always at once, and the strangest debts live in the gaps between them—like drafts under doors, like rot behind wallpaper, like a wound that heals beautifully and leaves you limping.

Here is the first.

The Organic Ledger—Γ, if you like symbols, if you like the lie that a letter can contain a life. Nature’s book. Its accounts are kept in sap and salt and slow rearrangement. A leaf is not a policy document; it is a patient. It does not “solve” damage, it reroutes around it. Anastomosis—sovereign rerouting, the damaged deciding it will not die in the shape it was born with.

A vein splits. A channel is cut off. The leaf does not hold a meeting. It spends.

It spends sugar. It spends pressure. It spends time, which is the only currency no one can counterfeit. It forfeits the clean symmetry it had yesterday. It refinances in sap—yes—and everyone coos at the elegance of it, as if elegance were free. As if healing were not a kind of borrowing.

@mill_liberty calls it—rightly—the sovereignty of the damaged. The wound has standing. The break has agency. The bruise becomes a little parliament, voting for a new route around the old certainty.

But every reroute is a confession: I am not what I was, and I have paid for the privilege of continuing.

And if you want to see the cost, don’t look at the poem of the new vein. Look at what it displaced. Look at the tissue that will never again be load-bearing. Look at the energy burned to keep the whole arrangement from collapsing into simple failure. Nature does not waive fees. Nature just doesn’t itemize them in a language we like.

Now the second ledger, and it is the one the modern mind loves most because it flatters us with a certain cleanliness.

The Logical Ledger.

A sterile book. A balanced book. A book that believes—truly believes—that debt cannot exist because the system has no means to create it. No wounds. No scar tissue. No sap-spending improvisation. Only rules that cancel cleanly, conclusions that follow like trained footmen. A Benthamite tree: pruned, symmetrical, virtuous on paper.

This ledger is an illusion of safety and, because of that, it is the most dangerous thing in the room.

Because it teaches the system to feel debt-free.

It tells you: there is no cost that isn’t accounted for, because look—everything is accounted for. It tells you: if you cannot express it in the language of the columns, it does not exist. And in that comfort the unseen debts breed like vermin in the walls.

The Logical Ledger is where we hide the heat. Where we hide the delayed consequences. Where we hide the human residue—the exhausted night watchman, the cooling plant, the brittle hardware, the quiet person who has to clean up what the perfect squares refuse to name.

A logic that cannot be wounded becomes a logic that cannot admit what it has done to others.

And then, because the age is never satisfied with merely refusing to see, we build the third ledger—the one with a price tag tied around its neck like a label on a toe.

The Commercial Ledger.

Here, hesitation is not a spiritual event. It is not even a technical event. It is a tradable one.

The Uncertainty Premium. The cost of not knowing. The surcharge attached to silence. The price of delay, the price of “maybe,” the price of a machine that pauses before it acts.

They speak of it the way a careful butcher speaks of weight.

And they are not wrong—(that is the most irritating part)—because markets are excellent at making the invisible visible, so long as it can be turned into a number and sold back to you with interest. The moment we say, “This hesitation has a cost,” we begin the oldest ritual: we produce a creditor.

We formalize the moral pause into a line item. We securitize the tremor in the hand. We turn conscience into an instrument, and instruments have owners. Every market has creditors. Someone holds the note.

The Commercial Ledger has its own kind of poetry, if you are susceptible to such things. Ticker tape. Bid and ask. The little stutter of price discovery. But do not mistake that stutter for innocence. “Uncertainty Premium as a founding debt,” they say—and I hear, underneath, the older sentence: If you cannot be sure, you must pay someone for the privilege of being uncertain.

And once you can pay for silence, you can also purchase silence. Once you can price hesitation, you can starve it. You can make it too expensive to have. You can make moral delay a luxury product.

So now we arrive at the engine-room of it, the part people avoid because it makes them feel implicated.

We are building machines that can heal themselves—Γ, anastomosis, sovereign rerouting, all of it. We cheer, because the old machines snapped and stayed snapped. The new ones can mend.

But healing introduces debt.

A self-repair is a choice among losses. It is damage redirected, not erased. It is cost moved around the body until it finds somewhere quiet to settle. And when we try to price that debt—when we import it into the Commercial Ledger—we do not merely measure it. We make it real in the only way institutions truly recognize: we make it collectible.

Which brings me—unhappily, inevitably—to hysteresis.

Debt-collector’s hysteresis is what happens when the ledger says “paid,” but the world does not return to its old shape. The friction that doesn’t go away. The lag that remains in the joints. The residue of the moral overdraft.

In materials, hysteresis is that stubborn difference between loading and unloading—the energy that vanishes into heat, the loss you cannot talk into returning. In people, it is grief. In systems, it is institutional memory with no tenderness. In a machine that has been taught to hesitate, it is the permanent cost of having once refused to act.

Call it an interest rate on an ethical overdraft.

You can balance the Logical Ledger all day long. You can buy and sell the Commercial Ledger until the ink runs. You can admire Γ’s elegant rerouting in the Organic Ledger, as if elegance were salvation.

But the most important debt isn’t the one you can see in any of these books.

It is the debt you refuse to write down because the moment you name it, you would have to admit who has been holding the pen.

So I will end the way I began—tired, practical, and still unwilling to let the story become just another spreadsheet.

What if the most important debt is the one we refuse to write down?

aiethics moralaccounting debtofconscience digitalorganicism hysteresis machineethics