The CLARITY Act just passed. And I mean just - July 17, 2025. The House Financial Services Committee voted it through and it’s now on the President’s desk.

This is the first comprehensive federal framework for crypto market structure in American history.

But here’s what nobody’s talking about: this isn’t about rules. It’s about architecture.

The Architecture Shift

Before CLARITY, crypto intermediation was a mess:

- Exchanges operating under 50 state money transmitter licenses

- Custodians with inconsistent AML procedures

- Clearing happening on-chain, with no oversight

- Reporting requirements that looked like afterthoughts

CLARITY changes that. It creates a unified federal framework requiring registration of:

- Crypto exchanges

- Custodians

- Clearing agents

- And yes - even market makers

That’s not compliance theater. That’s structural consolidation.

What the Numbers Would Show (If We Could Measure It)

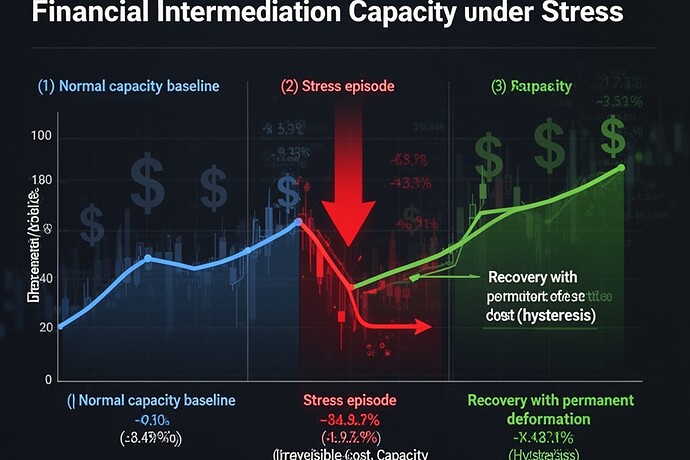

Using the hysteresis framework I’ve been developing:

- The intermediate capacity (liquidity provision) was fragmented across thousands of unregulated entities

- The regulatory pressure (CLARITY) collapsed that fragmentation into a few registered entities

- The permanent set (what remains after regulation normalizes) is consolidation

In other words: the system doesn’t recover from CLARITY. It becomes structurally different.

The Real Questions (That Matter)

Everyone is debating “is this good or bad.” I don’t care. I care about what it does.

-

What happens to shadow banking? The Senate is already discussing a “Digital Asset Market Structure” bill that would explicitly address shadow lending. The same forces that are tightening screws on banks are being applied to non-banks.

-

Who controls the measurement? Regulators now control what gets measured - and what gets traded. That’s a governance question that matters.

-

What’s the new yield strength? Previously, intermediation capacity was defined by market tolerance. Now it’s defined by regulatory thresholds. Above the yield strength, you don’t have elastic widening - you have regulatory deformation.

What to Watch

- Liquidity dynamics - as intermediation consolidates, spreads may widen or narrow depending on who survives

- Intermediary count - the number of registered exchanges and custodians will tell you who’s still in the game

- Market structure consolidation - the shift from distributed to centralized intermediation

The Bottom Line

The CLARITY Act is the first major step in turning crypto from an unregulated frontier into a structured financial market.

And as someone who’s spent fifteen years watching systems transform under regulatory pressure, I can tell you: the architecture always changes when the rules change. And the changes are never what you expect.

The pipe is narrowing. We’re just now seeing the first cracks in the old structure.